“They’re doing a great job of marketing a capability that already exists,” Mr. “The way we’re using data and how much we’re able to calculate and do online - this is brand new to the industry,” said Regis Hadiaris, the product lead for Rocket Mortgage.īut Rajesh Bhat, the chief executive of Roostify, a provider of automated mortgage transaction technology, suggested that Quicken’s new platform isn’t necessarily an industry first. (The signing of the final closing documents requiring notarization is done offline.) Once borrowers have selected a loan, they can follow through by signing the necessary documents online in a secure portal. The system analyzes the information, then quickly delivers suggested loan options that are customizable, so borrowers see which rates and terms suit them.

#Quicken mortgage rates manual

No manual uploading of documents is required.

Fill in your birth date and social security number, and the system pulls your income history. For example, if you’re applying for a refinancing, once you punch in your home address, the system automatically knows how much you pay in property taxes and homeowners insurance, as well as what you paid for your home.

#Quicken mortgage rates full

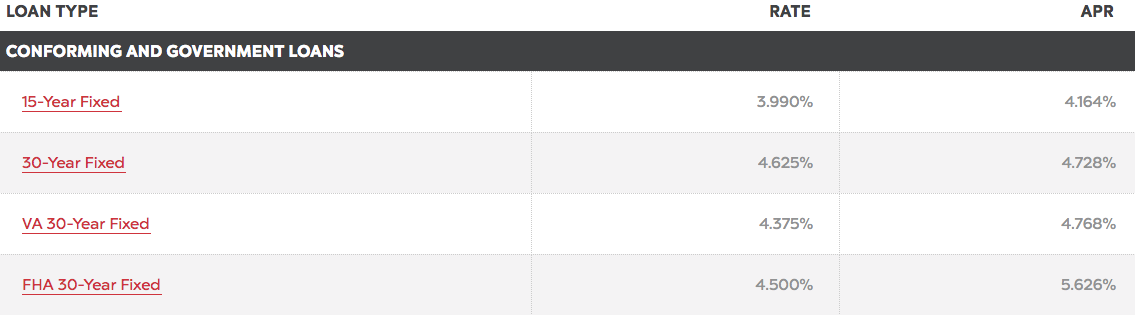

Under the traditional process, most borrowers have to go through several steps: They consult with a mortgage representative in person or over the phone, provide some basic information for preapproval, and then later furnish pay stubs, bank statements, tax returns and other documentation in order to obtain full approval.Īpplicants for a Rocket Mortgage need only to provide a few details about themselves to enable the new Quicken platform to pull that data on its own. The company says its new product will allow borrowers to be fully approved for a purchase or refinance loan in as little as eight minutes, simply by plugging in some personal details on their computers, tablets or smartphones. Quicken is the country’s second largest retail mortgage lender, according to the publication Inside Mortgage Finance. That's normal, but other lenders may charge less.Progress toward moving the entire mortgage approval process online made an apparent leap forward last month with the introduction of Quicken Loans’ Rocket Mortgage. You will need to buy mortgage discount points in order to get the lowest rate at Quicken Loans. Quicken Loans advertises competitive rates, but if you look at the fine print you'll see that the lowest mortgage interest rate comes at a significant cost. The government-backed programs here are the FHA loan and the VA loan. counties are USDA-loan eligible, but you won't be able to take advantage of that program through Quicken Loans. If you would prefer to take out a home equity line of credit or a home equity loan, you will need to look elsewhere. If you want to borrow against your equity, your only option at Quicken Loans is to get a refinance mortgage or a cash-out refinance loan. What could be improved No HELOC or home equity loan These are measures of customer satisfaction among major mortgage lenders that serve the general public (military-only lenders are not ranked). Power Primary Mortgage Origination Satisfaction Study, and the similar study for mortgage servicing. Quicken Loans ( Rocket Mortgage) regularly appears in the top two places on the J.D. Quicken Loans is known for its award-winning customer service. Also, qualified borrowers who meet income restrictions can get a conventional mortgage with 3% down.

If you don't have a military affiliation, you can apply for an FHA loan, which requires 3.5% down. If you qualify for a VA loan, you won't have to make any down payment. Quicken Loans offers several ways to get a mortgage with little to no money out of pocket. This feature is offered on 30-year conventional, FHA, and VA loans. If rates go down, you can request the lower rate one time. If you lock your rate and rates go up, yours will be locked in at the lower level. Quicken Loans offers a 90-day rate lock with a float down feature.

0 kommentar(er)

0 kommentar(er)